OneWeb: The main competitor to Starlink?

Elon Musk’s Starlink satellite internet constellation has established itself as the premier global satellite business broadband solution.

However, few know of their main competitor: Eutelsat-OneWeb, a joint venture with a hybrid satellite system and extensive partnerships with global telecom giants.

This article covers everything you need to know about OneWeb. Its owners, satellite technology, history, and how your business can leverage its network.

Contents

- What is OneWeb?

- The history of OneWeb

- OneWeb vs Starlink

- OneWeb Customer base

- Eutelsat-OneWeb and the UK

- The future of Eutelsat-OneWeb

- FAQs

What is OneWeb?

OneWeb is a satellite internet constellation of low Earth orbit (LEO) satellites that aims to provide high-speed internet access worldwide. It has now completed the launch of its first-generation constellation, which encompasses 648 satellites currently in orbit.

Unlike Starlink, OneWeb’s network focuses on connecting underserved and remote areas, offering broadband internet services to consumers, businesses, and governments.

Who owns OneWeb?

As of June 2024, Eutelsat-OneWeb is part of the newly christened Eutelsat Group, whose shares trade on the Euronext Paris Stock Exchange. The company has also applied for admission to the London Stock Exchange.

These are the major stakeholders in the company, excluding any public investors:

| Shareholder Name | % of Total Shares | Description |

|---|---|---|

| Bharti Enterprises Ltd. (India) | 23.83% | Indian conglomerate; strategic investment. |

| Bpifrance (France) | 13.59% | French public investment bank; early stage investor. |

| SB Investment Advisers (UK) | 10.89% | UK-based investment firm; later stage investor. |

| Government of United Kingdom (UK) | 10.89% | UK government entity; strategic interest. |

| CMA CGM SA (France) | 5.465% | Global shipping company; strategic partnership. |

| HANWHA SYSTEMS CO., LTD. (South Korea) | 5.444% | South Korean technology company; strategic investment. |

| ISALT (France) | 4.145% | French investment firm; long-term investor. |

| DNCA Finance SA (France) | 1.508% | French asset management firm; later stage investor. |

| Lazard Asset Management (USA) | 0.6371% | Global asset management firm; diversified investment. |

| Lemanik Asset Management SA (Switzerland) | 0.3504% | Swiss asset management firm; diversified investment. |

| Free Float (Various) | 40.67% | Shares held by public investors. |

| Company-owned shares (France) | 0.0911% | Shares held by Eutelsat. |

| Total | 100% |

The OneWeb history section below explains how this stake came to be.

The history of OneWeb

Here is an abridged run-through of OneWeb’s history:

The Origins of OneWeb: WorldVu

Originally called WorldVu, OneWeb was one of the first companies to start exploring satellite internet constellations made of small, assembly-line satellites orbiting at low altitudes.

It was founded by Greg Wyle, who, together with Elon Musk, advanced the idea in the early 2010s. Elon Musk was a core contributor until he pursued his venture with SpaceX.

In 2015, the dream became a reality as OneWeb secured its first $500 million in funding, primarily from Japanese holding company Softbank. A day later, SpaceX announced Starlink, marking the beginning of the fierce competition between both.

OneWeb continued raising capital from many global investors and started producing its satellites with Airbus Defense Systems in Florida, US. At the same time, SpaceX was building Starlink satellites in its giant factory in Redmond, Washington.

In February 2019, OneWeb launched its first six satellites, while Starlink launched its first sixty satellites three months later. The companies began launching neck-to-neck.

The first roadblock: Bankruptcy

OneWeb planned to launch around 30 monthly satellites until the COVID-19 pandemic derailed its plans. The company filed for bankruptcy in 2020 after failing to raise capital for 90% of its satellites.

In contrast, with the gargantuan financial support of Elon Musk’s growing empire, Starlink continued producing satellites and launching them from its launchpad.

The UK government and the Indian Bharti group invested $500 million each to refloat the company, each taking a 20% share. According to some experts, the UK made a strategic investment (and gamble) after losing privileged access to the European Galileo GPS network.

It looked like OneWeb was once again back on track. Throughout 2021, capital kept flowing, more strategic partnerships were set up, and a new CEO launched satellites as fast as possible.

By mid-2021, OneWeb had launched 33% of its satellites (218/648) compared to Starlink’s 13% (1,500/12,000).

The second roadblock: Ukraine invasion

OneWeb was steadily launching its satellites from Russia until the country suddenly launched a full-scale invasion of Ukraine.

The resulting international outcry meant that OneWeb (with its HQ in the UK) could not keep launching from there, even after pre-paying for their launches.

This forced OneWeb to start launching from SpaceX’s launchpad instead, incurring further costs and delays, not to mention using their competitor’s launchpad.

A new beginning: Merger with Eutelsat

OneWeb appeared to be losing relevance, so began looking for partnerships. Eutelsat, the third largest satellite operator in the world, appeared as the perfect fit, and the company merged in September 2023 to form the Eutelsat Group.

The merger was structured as an all-share deal, valuing OneWeb at $3.4 billion, and was approved by most of Eutelsat’s shareholders. OneWeb became commercially known as Eutelsat-OneWeb and continues to operate from itk London headquarters.

Eutelsat manages a network of high-altitude Telecomms geostationary satellites over 20,000km from the Earth, which could be combined with OneWeb’s LEO satellites to create a unique hybrid satellite internet network to compete with Starlink’s planned fleet of more than 40,000 small satellites and the upcoming Amazon Kuiper constellation.

By March 2023, OneWeb had completed all its planned stage one launch, reaching 648 satellites in orbit.

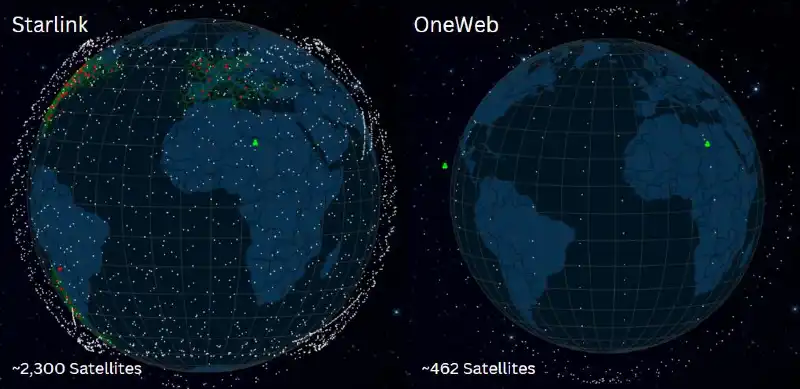

OneWeb vs Starlink

Eutelsat-OneWeb and Starlink’s main differences include their respective technology stack, ownership models, and target customer bases.

Here is a summary table:

| Feature | Starlink | OneWeb |

|---|---|---|

| Ownership | SpaceX | Eutelsat OneWeb (Joint Venture) |

| Primary Market | Consumer broadband | Enterprise, government, and underserved areas |

| Satellite Count | Over 6,000 (as of 2024) | 648 (as of 2024) |

| Orbit Altitude | ~550 km (LEO) | ~1,200 km (LEO) |

| Coverage Area | Global | Global |

| Service Availability | Available to consumers worldwide | Focus on enterprise and government customers; expanding to global coverage by 2023 |

| Satellite Size | Smaller, lightweight satellites | Larger satellites (~150 kg each) |

| Launch Partners | SpaceX (self-launched) | SpaceX, Arianespace, ISRO |

| Technology | Utilizes laser links between satellites | Ku-band radio frequencies, inter-satellite links, hybrid GEO/LEO network with Eutelsat |

| Initial Launch Year | 2019 | 2019 |

| Primary Objective | Provide high-speed internet to individual users | Provide high-speed internet for enterprises, governments, and remote areas |

| Key Investors | SpaceX (Elon Musk) | Eutelsat, Bharti Global, UK Government, SoftBank, Hanwha Systems, Bpifrance, Fonds Stratégique de Participations |

| Regulatory Status | Approved in multiple countries | Approved in multiple countries |

| Unique Features | Direct-to-consumer model, rapid deployment | Focus on enterprise solutions, strategic partnerships with Eutelsat for hybrid network |

Here are a few more details:

OneWeb vs Starlink: Tech stack

The OneWeb constellation of 648 satellites operates on a single orbital plane at 1,200km from the Earth’s surface, which is about double the distance of Starlink‘s 550km.

This higher plane was chosen because it’s less obstructed by existing space infrastructure (including space junk!) while remaining close enough to deliver low-latency, low-earth satellite internet. It also means that a lower density of satellites is needed to cover the globe.

Also, since the merger with Eutelsat in 2023, OneWeb has combined LEO satellites with geostationary satellites to create a hybrid network, potentially offering more robust coverage and reliability, especially in the polar regions (see image below).

In contrast, Starlink’s satellites orbit diagonally between the 60-degree northern and southern latitudes and will have less coverage in the polar regions until more satellites are launched.

As a result, OneWeb currently holds a monopoly of satellite broadband services for rural communities, energy companies, and climate research in places like Greenland and Alaska.

OneWeb vs Starlink: Customer base

Because of its technology stack and joint-ownership model, Eutelsat-OneWeb is significantly better positioned to target governments, enterprises, and telecom providers than retail customers.

Its hybrid LEO-Geostationary, super-reliable, high-coverage satellite network is more suitable for enterprise customers and governments that require reliable, high-capacity connectivity solutions for applications such as remote office connectivity, disaster recovery, and critical infrastructure.

Their joint ownership model, comprised of multinational entities, also makes it easier to partner with business broadband providers and mobile firms who want backhaul solutions to extend connectivity to remote areas. Telecom providers already have the customer base and the client-facing service, leaving Eutelsat-OneWeb entirely focused on the backend, business-to-business niche.

This contrasts with Starlink, which has taken on the task of managing infrastructure and customer services. In any case, neither network has the bandwidth necessary to support all 8 billion people and businesses around the globe, leaving ample market share for both.

OneWeb and the UK Government

The UK government invested $500 million in OneWeb during the COVID-19 pandemic, an awkward time for a strategic investment in the telecommunications sector. Our research indicates there were two main reasons for the UK to do this:

- The UK urgently needed its own encrypted GPS satellite network. Upon Brexit, the UK lost its privileged access to the EU Galileo GPS Satellite network, which provided encrypted positioning data for commercial and defence purposes. The government believed OneWeb satellites could carry the required GPS payload, but it was a technical gamble as these satellites were never designed for it.

- Dominic Cummings (the prime minister’s chief advisor at the time) wanted to bet on high-risk, high-tech initiatives to boost the UK economy through the newly formed “Blue Skies” Science research agency, which aimed to mimic the US’s Advanced Project Research Agency.

Has the UK government benefitted from buying OneWeb?

The UK’s investment in OneWeb is still promising even though the GPS solution is not viable. All 648 planned satellites were launched, and the Eutelsat merger was completed. Despite Starlink and Amazon’s Project Kuiper competition, OneWeb’s focus on enterprise and government markets provides a unique edge. The investment has created high-tech jobs in the UK, but international regulatory challenges and financial profitability remain critical for long-term success.

Eutelsat-OneWeb partnerships in the UK

Besides the UK government, Eutelsat-OneWeb provides satellite broadband to multiple enterprise and research institutions. Here is a list:

| Sector and Clients/Partnerships | Details |

|---|---|

| Government and Public Sector: UK Government | Utilizing OneWeb for national security and public sector applications. Source: GOV.UK. |

| Aviation: Intelsat, EchoStar/Hughes Network Systems, Panasonic Avionics | Providing in-flight connectivity to several airlines. Source: Advanced Television. |

| Enterprise and Utilities: Various Companies | Connectivity for remote operations and IoT. Source: OneWeb. |

| Maritime: Maritime Sector | Reliable communication for vessels. Source: OneWeb. |

| Research: British Antarctic Survey | Enhancing scientific research capabilities. Source: GOV.UK. |

The future of Eutelsat-OneWeb

Eutelsat-OneWeb is uniquely positioned to keep growing in the business and institutions sector, becoming the backend infrastructure used by telecom providers, governments, research institutions and enterprises. This is thanks to its unique hybrid satellite network, combined with the vast partnership-making potential of its influential stakeholders.

However, there is always uncertainty about the future in the fast-paced technology sector. Not only are growing 5G and fibre optic networks enabling ample wireless connectivity but there is also growing competition from Starlink and the incoming Kuiper satellite network, courtesy of Amazon.

Fortunately for OneWeb, the satellite broadband market share comprises 8 billion people worldwide, a huge proportion of whom remain disconnected due to a lack of global internet penetration.

OneWeb – FAQs

Our business broadband experts answer commonly asked questions on Eutelsat-OneWeb.

What services does OneWeb offer?

OneWeb offers high-speed, low-latency satellite internet services globally. These services include broadband connectivity for remote and underserved areas, reliable internet for maritime and aviation sectors, robust business communication networks, secure and resilient communications for government and military operations, and support for Internet of Things (IoT) applications with global coverage.

OneWeb currently only works directly with huge multinational businesses, organisations and governments. Businesses can indirectly access OneWeb’s broadband service via a Satellite business broadband brand.

What are the benefits of using OneWeb’s satellite internet services?

OneWeb’s satellite internet services offer global coverage, high-speed, low-latency connectivity, and reliability. Here’s how this compared to other business broadband services:

- 5G business broadband – Faster speeds, but coverage only available in urban areas.

- Fibre optic business broadband – Faster, more consistent speed, but only available to properties adjacent to the Openreach or other fibre networks.

- Full fibre business broadband – Up to gigabit speeds as does not rely on copper landline cabes.

- Leased line broadband – Unrivalled speeds but prohibitively high business broadband prices.

Use our business broadband comparison service today to get expert advice from our team.

How does OneWeb ensure the reliability and security of its network?

Eutelsat-OneWeb ensures network reliability through its hybrid constellation of LEO and geostationary satellites that provide consistent global coverage and low-latency connections. For security, OneWeb employs advanced encryption, secure gateways, and robust cybersecurity protocols to protect data and communications across its network.

What is Airtel OneWeb?

Airtel OneWeb is a partnership between Bharti Airtel (see list of stakeholders) and Eutelsat-OneWeb to provide satellite internet services in India and neighbouring regions. This collaboration aims to deliver satellite broadband and mobile connections to remote and underserved areas of India.

Resources

- OneWeb Launch – Youtube

- UK Gov Statement – One merger w/Eutelsat

- The Guardian – ‘We’ve bought the wrong satellites’

- The Guardian – ‘Blue Skies, High-risk, high-reward science’

- The Guardian – UK buys shares in OneWeb

- The Guardian – Eutelsat takes over OneWeb

- OneWeb – Website

- satellitemap.space – Starlink and OneWeb Satellite map

- PR News Wire – OneWeb announcement

- Youtube – OneWeb in Greenland

- Youtube – Mobile Internet Resource Center

- NBC News – OneWeb $500million

- Starlink Stats

- Front Image: Spacenews